ATW Token - Tokenomics

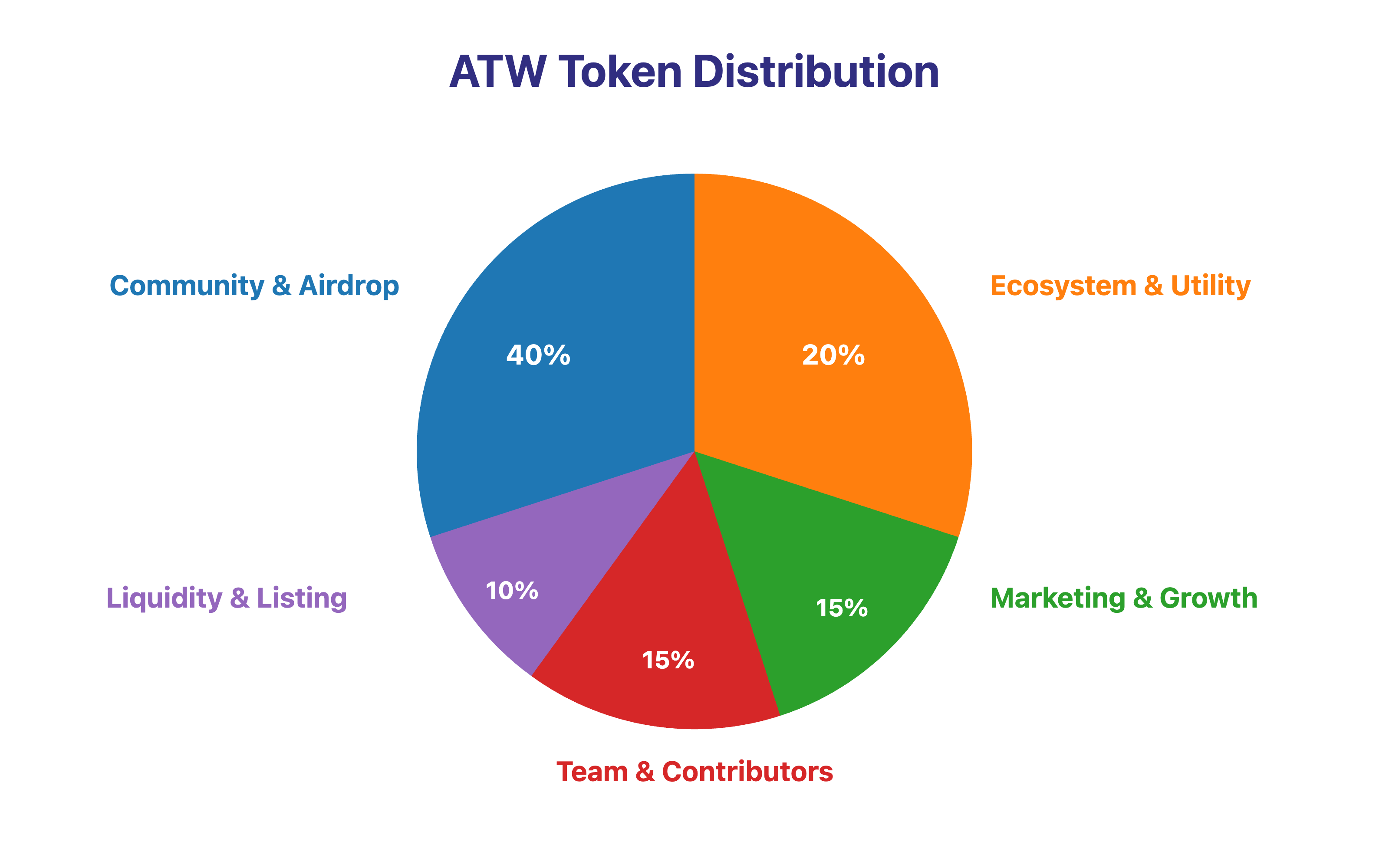

ATW Token Distribution (Total Supply: 1.000.000.000 ATW)

Total Supply

The total supply of the ATW Token is 1,000,000,000. The supply is fixed; no additional tokens will be minted, and no inflationary mechanisms are implemented.

This fixed supply model is designed to ensure long-term predictability, economic discipline, and transparency.

Community – %40

This pool is allocated to share value with the community supporting the project and to grow the ecosystem together. Users who actively engage with the platform, contribute to its development, and support the ecosystem are rewarded through this structure.

Community distribution is designed with a focus on long-term engagement and sustainable usage rather than short-term participation. This approach aligns the success of the project directly with its community, aiming to build a strong and enduring ecosystem.

Ecosystem & Utility – %20

This strategic allocation is designed to support the technical sustainability of the ecosystem and expand the functionality of the products. The ATW Token is positioned as the core value layer that enables and activates on-platform utilities.

Staking & Tier System

Supports a tiered access model where users lock ATW tokens to benefit from lower platform fees, advanced AI analytics tools, and premium API features.

Governance & Ecosystem Decisions

Utilized as an incentive and participation mechanism for ecosystem development proposals, governance processes, and treasury-related decisions.

Product Adoption Incentives

Covers user-focused reward and support mechanisms that encourage the adoption of new modules developed across atWallets and Raydar.

Marketing & Growth – %15

This allocation is designed to support the project’s global expansion and ensure the development of a healthy and sustainable market structure.

Exchange Listings & Liquidity Support

Covers listings on centralized exchanges and collaborations with market makers to support trading depth and market efficiency.

Global Expansion & Community Growth

Supports brand awareness initiatives, international community growth, and strategic media activities across global markets.

B2B & Strategic Partnerships

Includes incentive programs and co-marketing initiatives for enterprise partners utilizing the Raydar infrastructure at a corporate scale.

Team & Contributors – %15

This pool is allocated to maintain the long-term motivation of the core team and contributors providing technical or strategic value to the project.

Lock-Up & Vesting Model

Tokens allocated to this pool are subject to lock-up and are released gradually according to a structured vesting schedule.

Long-Term Alignment

The distribution structure is designed to ensure the team remains focused on product development and long-term vision, independent of short-term market movements.

Liquidity & Listing – %10

This allocation is reserved to ensure a balanced, accessible, and healthy trading environment from the moment the token enters the market.

DEX Liquidity Provision

Provides liquidity depth on decentralized exchanges (e.g., Uniswap) to support price stability and efficient trading.

Trading Accessibility

Ensures sufficient liquidity reserves to allow users to buy and sell ATW with minimal slippage.

Deflationary Burn Mechanism

The ATW Token is built on a usage-driven economic model where total supply decreases over time. The burn mechanism is directly linked to platform activity.

Activity-Based Burn

A portion of the revenue generated from premium services, B2B integration fees, and paid AI tools is automatically burned through smart contracts.

Usage-Driven Deflation

The burn rate is not fixed; as platform usage and revenue volume increase, the number of tokens removed from circulation increases proportionally. This structure naturally aligns token value with ecosystem growth.