Introduction

The digital asset ecosystem is becoming increasingly fragmented, driven by the rapid growth of centralized and decentralized platforms, on-chain applications, multi-wallet structures, and a wide variety of asset types. Users are required to rely on multiple applications and data sources to monitor their portfolios and interpret on-chain activity.

This fragmentation creates fundamental challenges, including data inconsistency, access complexity, and operational inefficiency. Aggregating data from disparate sources into a single, coherent view has become a significant burden for users managing digital assets.

atWallets is a technology ecosystem designed to provide a standardized and unified view of digital assets, regardless of the platforms, protocols, or technologies on which they are held. By consolidating multiple data sources into a single infrastructure, atWallets enables users to manage all of their digital assets holistically under one unified environment.

The atWallets infrastructure is delivered to users through the Raydar interface. Raydar aggregates data from multiple exchanges, blockchains, and protocols into a single dashboard, providing an integrated and seamless digital asset management experience.

This whitepaper outlines the vision of the atWallets ecosystem and presents the high-level architectural approach that underpins the Raydar infrastructure.

Problem Definition

While the digital asset ecosystem has expanded rapidly in recent years, it has also introduced significant fragmentation across user experience, data integrity, transaction management, and portfolio control. Today, users are required to continuously switch between centralized cryptocurrency exchanges, decentralized trading protocols, software and hardware wallets, staking and yield platforms, on-chain applications, and multiple blockchain networks. Each of these platforms operates with its own data structures, pricing methodologies, API standards, and update frequencies, creating substantial operational and analytical complexity.

This fragmentation extends beyond asset custody. Spot, margin, and derivatives positions opened across different exchanges; open orders, leveraged exposure, liquidation thresholds, and transaction histories are dispersed across separate systems. A single user’s positions may be simultaneously active on centralized exchanges, on-chain protocols, and derivative mechanisms operating on different networks. This significantly complicates holistic position tracking and effective risk management.

In addition, orders transmitted directly to exchanges become immediately visible in public order books, which can pose strategic transparency risks—particularly for professional traders and institutional participants executing large-volume transactions. Under certain market conditions, such visibility may lead to price slippage, spread widening, or unintended market reactions. These effects must be understood within the context of market microstructure, information asymmetry, and liquidity dynamics.

The dispersion of cryptocurrencies, tokens, NFTs, liquidity pool assets, staking positions, yield farming returns, and other on-chain holdings across disparate systems prevents comprehensive analysis of pricing, valuation, risk, returns, leverage, and transaction history within a unified framework. Similarly, identifying arbitrage opportunities, analyzing inter-exchange price discrepancies, accurately calculating transaction costs, and conducting detailed profitability assessments become manual and complex processes for users. Most existing platforms rely on short-term price-based PnL indicators, which can produce misleading results for positions held over extended periods.

To address this structural limitation, APL (Average Profit/Loss) has been designed as an analytical layer that calculates time-based net performance by incorporating all cash inflows and outflows, transaction fees, and realized gains and losses on a per-position basis. By moving beyond traditional short-term PnL metrics, APL aims to present portfolio performance in a realistic, sustainable, and comparable manner.

APL (Average Profit/Loss) Formulation

Unlike traditional PnL calculations, APL employs a time-weighted and cost-based approach:

Incompatibilities between platforms and asset types lead to fundamental challenges such as fragmented access, data integrity issues, difficulties in transaction tracking, and increased operational overhead. Data originating from multiple sources may be updated with delays, conflict with one another, or be presented in non-standardized formats, making it difficult to accurately correlate and interpret this information in a unified manner. As a result, users are forced to manually track their assets across dispersed applications rather than monitoring them through a single, consolidated interface.

This fragmented landscape introduces additional risks, including time inefficiencies, overlooked positions, unexpected liquidation events, inaccurate assessments, and operational errors. Consequently, despite its scale and potential, the modern digital asset ecosystem lacks a unified layer that provides holistic visibility, effective position management, and comprehensive risk analysis. The current state of the ecosystem clearly demonstrates the need for an integrated Digital Asset SuperApp infrastructure that enables users to securely, completely, and centrally manage all assets and open positions under a single framework.

The atWallets Approach

atWallets is a unified asset and transaction management infrastructure designed to consolidate the fragmented structure of the digital asset ecosystem. The platform aggregates user data across multiple exchanges, wallets, networks, and decentralized finance protocols under a single standardized framework, while also centralizing transaction and position control permissions within a unified control layer. As a result, users can view and manage their entire portfolio and all open positions from a single interface, regardless of whether transactions are executed on centralized exchanges or on-chain protocols.

The atWallets approach extends beyond data integration alone; it aims to unify the entire lifecycle of crypto asset management within a single application. Core functionalities such as portfolio monitoring, position management, spot and derivatives trading, risk tracking, order execution, and on-chain analytics are delivered as a cohesive and integrated experience. The platform also eliminates the need for manual calculations by consolidating advanced analytical components—such as cross-exchange price differentials, arbitrage opportunities, transaction cost analysis, and APL (Average Profit/Loss), which measures a user’s true profitability—under a single framework.

Through optional transaction write permissions, users can execute orders, close positions, rebalance portfolios, and perform risk management operations on connected exchanges directly via the Raydar interface. This architecture enables all trading activities to be managed from a single control point, without the need to navigate fragmented interfaces, complex trading screens, or repetitive authentication processes across multiple platforms.

This integrated architecture encompasses not only portfolio and transaction control, but also market intelligence and information flow. atWallets provides a comprehensive management layer supported by price movements, on-chain activity, news feeds, market alerts, and user-specific analytics. In addition, Raydar’s protected order execution architecture mitigates strategic transparency risks, front-running exposure, and liquidity-driven price volatility caused by premature order visibility in public order books. Orders are withheld from exchanges until predefined price thresholds are approached, preventing the exposure of user strategies and enabling more controlled, secure, and predictable execution.

Raydar Strategic Order Execution (SOE) Algorithm

Rather than submitting orders directly to exchanges, Raydar manages order execution through a Threshold Trigger mechanism:

The core architecture of the platform is built not as a custodial system, but as a control layer operating through secure API connections that support read and optional write permissions. This design ensures that asset custody and fund security remain entirely under the user’s control, while all data and transaction workflows are managed in a consistent and secure manner within the atWallets ecosystem.

In conclusion, atWallets consolidates all critical components of digital asset management into a single application—ranging from data aggregation and standardization to advanced analytics, APL-driven performance measurement, risk monitoring, transaction execution, and order visibility optimization. This unified approach delivers a comprehensive and sustainable digital asset management experience based on the principles of a single ecosystem, a single application, and full user control—meeting the demands of the modern crypto landscape.

Ecosystem Architecture

The atWallets ecosystem is built on a multi-layered and modular architecture that unifies all components of digital asset management within a single structure. This architecture is designed as a set of interconnected yet independently scalable layers, encompassing data aggregation, standardization, analytics, transaction execution, and user experience. The primary objective is to deliver data originating from diverse platforms, networks, and protocols to users through a secure, consistent, and unified infrastructure.

At the foundation of the architecture lies the connectivity layer, which establishes secure communication with centralized exchanges, decentralized protocols, on-chain data sources, and wallet technologies. Through this multi-source connectivity model, data is collected independently of its origin and transformed into a common standardized format. Assets, positions, orders, account movements, and on-chain activities are normalized at this stage, enabling users to access a holistic and consolidated portfolio view.

Positioned above the connectivity layer, the standardization and analytics infrastructure correlates and contextualizes data received from multiple sources, transforming it into a coherent and actionable dataset. This layer integrates not only user-specific information but also market data, on-chain activity, news feeds, and other macro-level indicators. As a result, users can evaluate both their portfolios and broader market dynamics within a single unified environment.

The transaction execution layer represents one of the key differentiators of the atWallets architecture. The platform provides a centralized control mechanism for order placement and position management across connected exchanges. This layer is enhanced by Raydar’s strategic execution architecture, designed to reduce order visibility and mitigate manipulation and liquidity-related risks associated with direct exposure to public order books. Managing multiple execution venues through a single control point significantly improves both security and operational efficiency.

This multi-layered architecture is delivered to users through the Raydar application. Raydar serves as the user-facing layer of the ecosystem, consolidating portfolio visualization, position tracking, order management, on-chain analytics, market data, and customizable alerts within a single interface.

In conclusion, the atWallets architecture is a holistic and scalable ecosystem composed of data connectivity, standardization, analytics, transaction execution, and user interface layers. Its modular design is intentionally structured to address current digital asset management requirements while remaining adaptable to future asset models, protocols, and technological evolutions.

Raydar Operational Flow

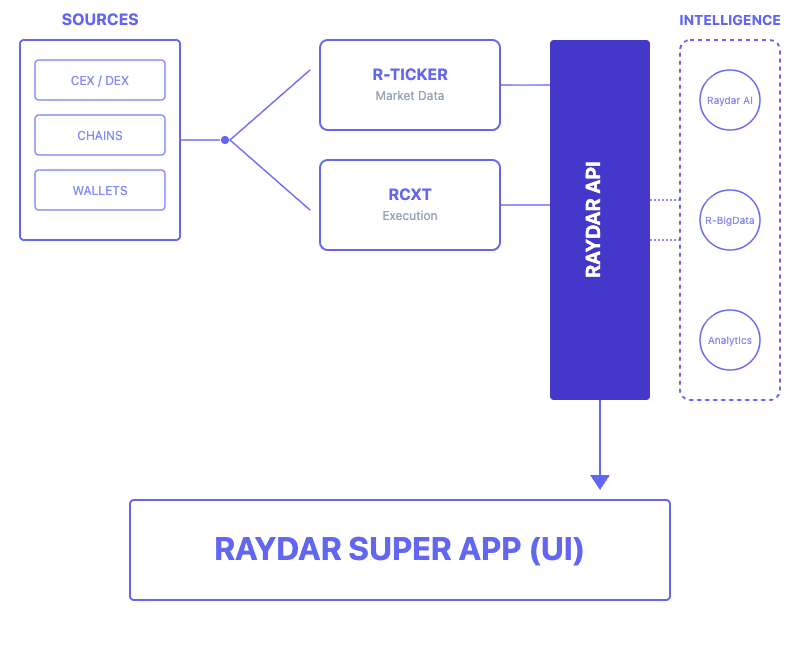

Raydar serves as the central control panel of the atWallets ecosystem, consolidating all data flows, analytical processes, and transaction execution layers within a single user interface. While user interaction takes place through Raydar, background operations—including data aggregation, standardization, analytics, decision support, and order routing—are handled by RCXT, R-Ticker, R-Big Data, and Raydar AI.

This schematic representation illustrates Raydar’s role within the ecosystem at a high level.

atWallets Components

The atWallets ecosystem is built on a multi-layered product architecture that unifies crypto asset management, data analytics, transaction execution, and financial insight generation within a single framework. This architecture is designed to deliver scalable, reliable, and integrated services for individual users, professional traders, and institutional participants alike. The core products and components of the ecosystem are outlined below.

RCXT – Raydar Crypto Exchange Tunnel

Unified Access Layer for CEX, DEX, Wallets & Blockchains

RCXT is an integration infrastructure that connects centralized exchanges (CEX), decentralized exchanges (DEX), blockchain networks, smart wallets, and third-party crypto service providers through a single unified API surface. Instead of managing multiple independent integrations, institutions can handle data flows and transaction execution through a standardized protocol.

Designed with high scalability, low latency, and secure operations in mind, RCXT is optimized for fintech companies, asset managers, exchange operators, and enterprise-grade blockchain projects.

R-Ticker Engine

Multi-Exchange Market Data Normalization & Distribution Layer

R-Ticker is a high-performance market data engine that aggregates real-time data from multiple centralized crypto exchanges, normalizes it into a unified schema, and distributes it according to various consumption models. The system is optimized for trading, analytics, and signal-generation platforms that require low latency and consistent data structures.

Raydar API – Developer & Enterprise Integration Layer

Raydar API is the integration layer that exposes all data components of the atWallets ecosystem to third-party applications and enterprise systems. Market data, portfolio information, transaction history, on-chain activity, and analytical outputs are delivered through a single API interface. With REST and WebSocket support, integration timelines are shortened and operational costs are reduced.

Raydar AI – AI Powered Analytics Layer

Raydar AI is the artificial intelligence layer responsible for generating market forecasts, trend analyses, anomaly detection, portfolio risk scoring, and user-specific strategy recommendations. It supports tax optimization insights, early risk warning mechanisms, and advanced risk management models for both individual and institutional users.

R-Big Data – Historical & Analytical Data Repository

R-Big Data is the large-scale data storage and analytics infrastructure that houses historical price series, transaction records, volume data, and on-chain metrics. This layer supports deep research, financial modeling, machine learning workflows, and time-series analysis, serving as the primary data foundation for Raydar AI.

Raydar – Crypto Super App Control Center

Raydar is the primary user-facing interface and central control panel of the atWallets ecosystem. It delivers a holistic digital asset management experience by consolidating assets held across multiple exchanges, open positions, orders, transaction histories, risk exposure, and tax implications into a single interface. Raydar’s core objective is to transform fragmented crypto data into a unified and manageable control layer.

Portfolio Management

Users can view all exchange balances on a single screen and filter assets by exchange, token, or currency. Total portfolio value can be tracked in real time using fiat currencies such as USD, EUR, and GBP—issued by the ECB and other central banks—as well as BTC or other crypto-denominated units. Diverse asset types across different exchanges are normalized into a standard format, making portfolio distributions transparent and comparable.

Orders & Trades

Open orders, completed trades, and full transaction histories are presented in a single consolidated view. Users can access detailed information for each transaction, including entry price, quantity, fees, trading pair, timestamp, and exchange source. Where supported by integrations, spot, margin, and derivatives positions are displayed separately.

Profit/Loss & Average Cost (PnL & Avg Cost)

Instead of relying on traditional 24-hour PnL calculations, Raydar applies the APL (Average Profit/Loss) methodology. APL accounts for all cash inflows and outflows, commissions, fees, and the time-based carrying cost of positions to calculate true profitability. Analyses can be performed at the asset, exchange, or consolidated portfolio level, with average cost bases automatically calculated. This approach delivers a clear view of sustainable and comparable performance over time.

Arbitrage View

Raydar displays side-by-side price comparisons for the same asset across multiple exchanges, presenting arbitrage opportunities through both visual and numerical indicators.

Smart Calculators

Pre-trade decision-making is supported through smart calculation tools, including position sizing, risk management, target price and profit estimations, DCA (Dollar-Cost Averaging), and break-even calculators.

Smart Multi-Exchange Alarms

Raydar’s advanced alarm system enables users to monitor market movements across multiple exchanges simultaneously, eliminating the need for constant manual surveillance. With customizable triggers for specific prices or profit/loss percentages, traders can set precise conditions to capture critical market shifts on any connected platform. Instant notifications ensure that once a target is hit on any selected exchange, you can act immediately to optimize your strategy.

Trading Console

Users with active Raydar connections can manage all trading functions—such as order placement, position closure, stop/limit orders, and portfolio rebalancing—through a single unified console. This capability elevates Raydar beyond a portfolio tracking tool, delivering a true Crypto Super App experience.

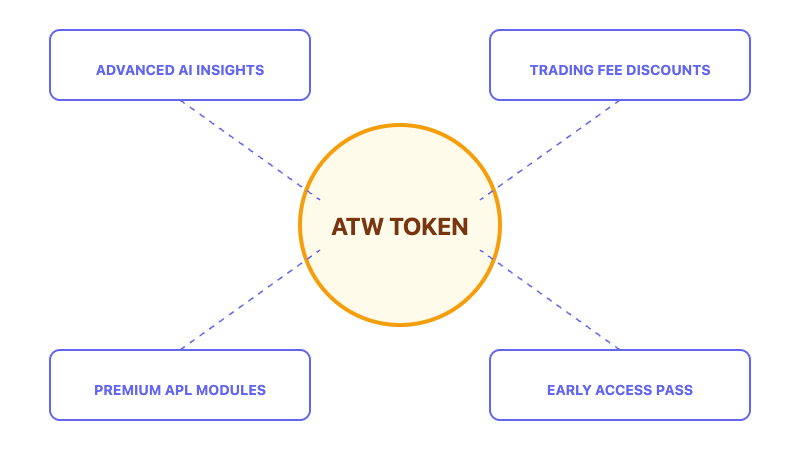

ATW Token - Ecosystem Utility & Value Layer

ATW Token is a utility token designed to enhance user experience within the atWallets ecosystem, enable access to premium services, and support the platform’s internal economic cycle. Selected advanced modules offered through Raydar are unlocked via ATW Token, providing users with additional functionality and privileges.

Premium analytical tools, advanced AI-driven modules, risk alert systems, and professional trading features unlocked based on user tier are activated through ATW Token. Users can access certain platform services using ATW Token instead of fiat currencies, creating a sustainable and continuous utility-driven demand for the token within the ecosystem.

In addition, ATW Token supports discounts on platform products and services, priority access tiers, and usage scenarios across partner applications. This approach positions the token as a native, functional value layer embedded directly into the ecosystem’s operational and economic design.

The ATW Token distribution model, airdrop mechanisms, and detailed token economics are beyond the scope of this whitepaper and will be addressed in a separate technical document.

Security Architecture & Privacy

As atWallets is designed as a non-custodial infrastructure that manages data, execution, and integration layers—rather than storing user funds—security architecture constitutes one of the platform’s most critical foundations. The system adopts a multi-layered security model encompassing API key protection, transaction execution safeguards, data encryption, and granular access control. The primary objective is to manage all data and transaction flows according to the highest security standards without ever taking custody of user assets.

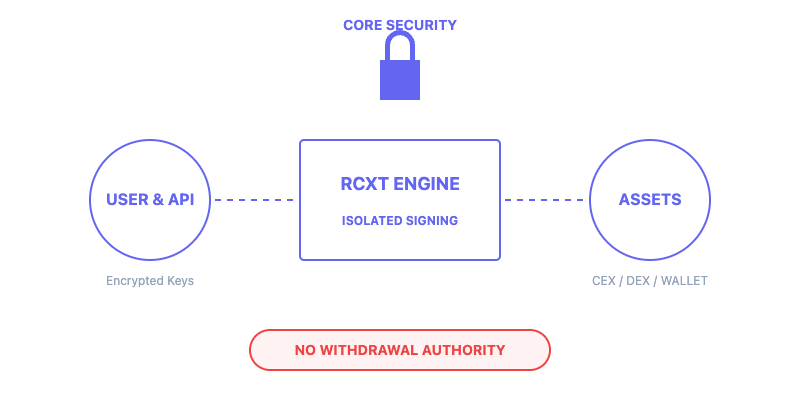

Non-Custodial Design Principle

The atWallets architecture does not store or hold user funds at any stage. Assets remain exclusively within the respective exchanges or wallets, while the platform interacts with these systems solely through authorized API connections. This non-custodial approach eliminates custody-related risks and significantly reduces the overall attack surface.

API Key Security

API keys provided by users to connect their exchange accounts are protected using strong encryption algorithms and are restricted to the minimum permission set required by RCXT. API keys are never stored in readable form, and all access requests pass through strict authentication and authorization layers. atWallets supports read-only and optional trade permissions only; withdrawal permissions are neither requested nor supported under any circumstances.

RCXT Transaction Security & Isolated API Architecture

RCXT is a security-first transaction infrastructure that unifies CEXs, DEXs, and blockchain networks under a single API layer. All data transmission occurs over HTTPS, while critical execution components operate within isolated environments with no direct external network exposure. Cryptographic signature generation is performed in secure execution environments, and signatures are transmitted to target platforms exclusively through isolated proxy layers. This design ensures that key materials and signing processes remain protected from external threats.

RCXT follows strict data minimization and stateless architecture principles, storing no persistent user data or sensitive transaction information. All operations are executed strictly within ephemeral transaction contexts, limiting the potential impact of any data breach.

Data Encryption & Fine-Grained Access Control

All user data is protected by modern encryption protocols both in transit and at rest. Granular access control mechanisms are enforced at the user, device, IP, and session levels. Every data request is subject to authorization checks, preventing unnecessary data exposure and unauthorized access.

Transaction Permission Isolation

Read and write (trade) permissions are fully segregated at the architectural level. Transaction execution is enabled only when explicitly authorized by the user; otherwise, the system operates strictly in a read-only data visualization mode. This separation minimizes the risk of unauthorized or unintended transactions.

Data Integrity & Synchronization Security

All data produced by RCXT, R-Ticker, R-Big Data, and Raydar AI is processed as timestamped, verifiable, and consistent records. Data synchronization is reinforced through cross-source consistency checks, while all transaction and analytics outputs are monitored via secure event logging systems.

Attack Surface Reduction & Continuous Security Monitoring

Through its non-custodial design, constrained permission model, isolated execution layers, and encrypted data handling, atWallets significantly reduces its attack surface. The system is continuously monitored through regular penetration testing, stress testing, and AI-driven anomaly detection mechanisms.

User Privacy & Data Protection

User data is processed in compliance with global privacy standards and applicable regional regulations. Personally identifiable information and portfolio data are strictly separated, and only the minimum required personal data is utilized to reduce privacy risk exposure.

Conclusion & Vision

atWallets is built to eliminate the fragmented structure that has emerged within the digital asset ecosystem over the years and to redefine crypto asset management under a single, unified standard. Raydar—powered by the RCXT execution infrastructure, real-time market data, big data analytics, and AI-driven decision layers—provides a central control platform where users do not merely observe their assets but actively manage their portfolios. ATW Token serves as the economic continuity layer of this architecture, representing the ecosystem’s native and functional utility layer.

The atWallets ecosystem is designed on a scalable, secure, and future-ready architecture that serves all user segments—from individual investors to professional traders and institutional participants. The platform’s vision is to move crypto asset management away from fragmented tools and temporary solutions toward a globally adoptable, trusted, and sustainable Crypto Super App standard.

This approach positions atWallets not merely as a product, but as a foundational infrastructure layer representing the next evolutionary phase of digital asset management.